Article

Beyond the Balance Sheet: Why UK Universities Need a Busyness Model

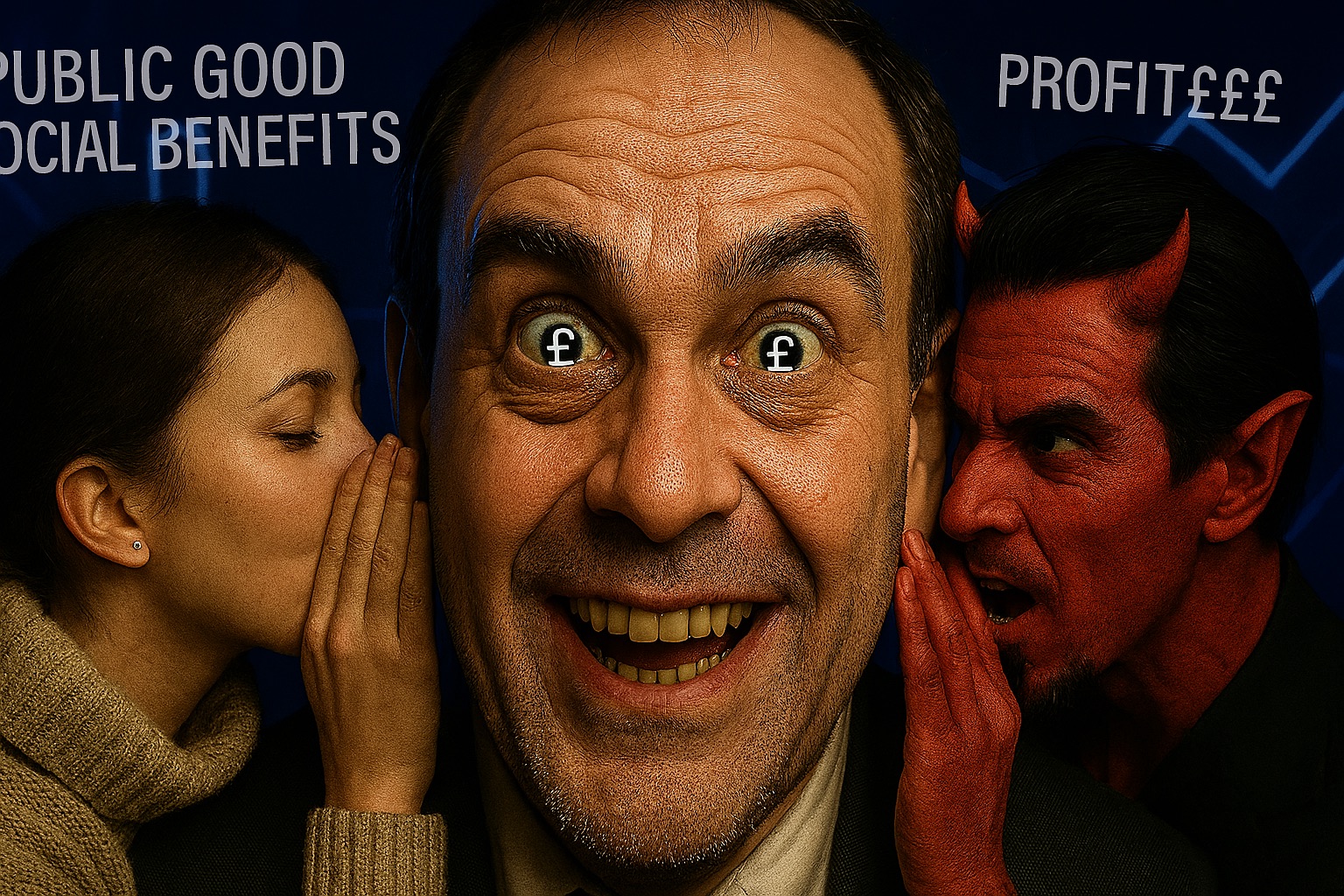

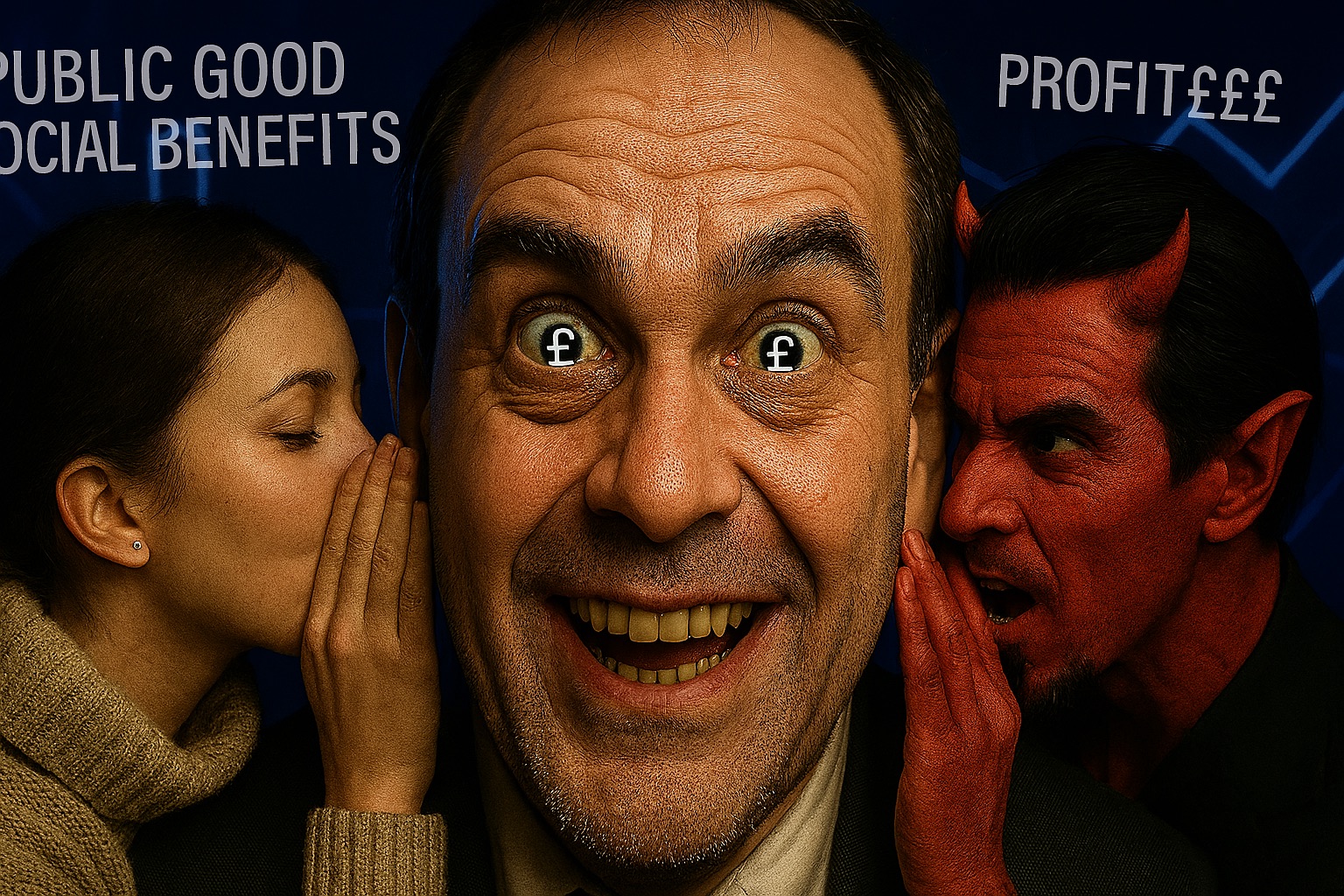

Calling a university’s strategy its “business model” is a bit like calling the Royal Opera House a karaoke bar— both involve singing for money, but that’s where the resemblance ends. Yes, the UK sector’s fiscal plumbing is hissing ominously, but the ‘business model’ mantra pares back a sprawling public-good ecosystem until it resembles someone trying to fund science with a primary-school bake sale.

A Semantic Shambles

The word business harks back to Old-English bisignes—”being busy with care,” not “squeezing out profit.” When vice-chancellors wax lyrical about their “business model,” we are no longer speaking of scholarship, discovery or civic duty; we are cooing over spreadsheets.

Busyness Vs The Biz

- In a functioning university, perhaps 2–3 % of staff genuinely busy themselves with treasury wizardry; the other 97 % teach quantum mechanics, conserve Saxon manuscripts or invent vaccines.

- Letting the financial tail wag the academic dog means treating lecturers as revenue streams and students as balance-sheet “units”—the ultimate triumph of nouns over nuance.

The Cash-Flow Tunnel Vision

What the Bean-Counters See

- Net operating cash-flow in English providers tumbled from 11.6 % to 6.5 % of income between 2021-22 and 2022-23. Ninety-three institutions are in deficit, 108 expect to join them this year.

- The Russell Group reckons up to 70 % of universities could plunge into the red by 2025-26 without intervention.

- 108 providers now sit on fewer than 30 days’ cash—financially akin to living on Pot Noodles until payday.

- Domestic tuition fees have risen precisely once since 2012; even a mooted jump to £9,535 barely dents inflation, leaving a teaching funding shortfall of £390 million per annum.

- Students foot the bill: average graduate debt in England hit £53,000 in 2024-25.

What This Tunnel Vision Misses

Cash-flow models treat higher education as a glorified ATM, ignoring the calculable extras:

- Total economic impact (2021-22): £265 billion—roughly £14 back for every £1 of public money.

- Graduate salary premium: median £42k versus £30.5k for non-graduates in 2024.

- Extra tax per graduate: roughly £75k drifts into the Exchequer over a lifetime.

- Lives saved by university research: 6.3 million worldwide in the first year of the Oxford/AZ vaccine alone.

- Health-span gain: each extra year of education trims adult-mortality risk by around 2 %.

The Wider Ledger: Civic, Regional and Planetary Dividends

- Universities act as “anchor institutions” spurring local growth; Birmingham’s 2024 study offers tidy ways to count the civic cash.

- Every £1 pumped into universities can add £14 to private-sector productivity—that’s £40 billion a year in fresh private-sector productivity.

- Northumbria University shows how study meets service: its award-winning Student Law Office has helped overturn wrongful convictions, while its Business Clinic offers free consultancy that keeps hundreds of local SMEs on track —proof that when students roll up their sleeves, academic graft turns directly into social value.

Social Return on Investment: The Missing Framework

We already possess a toolkit—Social Return on Investment (SROI)—to price such intangibles in pounds and pence. If you’ve ever sat through finance committee meeting, you’ll know the room divides neatly into two camps: those who can locate the decimal point on a spreadsheet, and those who nod earnestly while doodling owls in the margins. Social Return on Investment (SROI) was invented to help the latter persuade the former that rescuing humanities departments isn’t fiscal vandalism but, in fact, rather good value.

Put plainly, SROI asks: “What would society cough up in hard cash for the lovely side-effects of this project if it had to buy them at B&Q?” You start by identifying every stakeholder likely to benefit—students, local businesses, bored pigeons, whomever—then attach a sensible monetary tag to each outcome, from boosted earnings to fewer GP visits. Finally, you subtract the original outlay and produce a neatly reassuring ratio such as “£1 in, £3 out,” which even the sternest bursar can frame and hang next to the fire exit.

Because it translates woolly concepts like “community cohesion” into shiny pound signs, SROI is catnip to policymakers who worship at the altar of ‘evidence-based’. The snag, of course, is that assigning a sticker price to longer, healthier lives or a cheerier high street requires a smattering of judgement and (brace yourself) talking to real people. This is precisely why the method so often languishes in consultants’ slide decks while Whitehall merrily churns out pie charts based on easier sums—usually ones beginning and ending with tuition-fee income.

In short, it’s the accounting world’s polite reminder that some investments pay back in more than lucre.

Why the “Business-Model” Mindset Is Bad Business

- Short-termism – Cap-ex-obsessed MBAs siphon cash from fieldwork to plate-glass atria; The Guardian calls it “whitewashing the tomb” of scholarship.

- Perverse incentives – Chasing high-fee international students skews curricula and leaves institutions hostage to visa policy.

- Missing markets – Improved public health, civic stability and democratic engagement don’t show up on purely financial dashboards.

- Erosion of trust – When barely a fifth of spend reaches academic staff, students understandably ask, “What exactly does my debt fund?”

Towards a University Model—Not a Business Model

- Customer → Co-producer of knowledge

- Revenue stream → Social value stream

- Market share → Civic footprint

- Cost centre → Public-investment multiplier

Practical Fixes

- Embed SROI baselines in OfS returns so every programme reports both cash and social yields.

- Add a Public Value Statement to the annual report—template courtesy of UUK—quantifying graduate tax boosts, SME support, even carbon savings.

- Ring-fence curiosity-driven research (yes, the stuff that gave you the Covid jab) so it isn’t raided for short-term liquidity.

- Re-brand finance teams as enablers, not overlords: their job is to keep the lights on so everyone else can stay busy with the real work.

Final Plea

If a university’s very purpose is boiled down to its quarterly profit figures, we might as well convert the Bodleian into a bargain-bin bookshop flogging paperbacks two-for-a-pound. Universities, by etymology and by evidence, are about busyness in the broadest sense: the restless pursuit of knowledge that pays society back many times over—financially, medically, democratically.

What should the “business model” be? Busyness itself: teaching, probing, discovering—always with the public good in mind. Yes, the books must balance (stay tuned for my next piece on how), but the real dividends are educated citizens and new knowledge.